Costs, Expenses and How To Pay for Assisted Living

Summary: One of the most common questions that we receive by our site visitors is “How Much Does Assisted Living Cost, and How Do I Pay For It?” This page discusses how much one can expect to pay for assisted living, and the numerous options to pay for it – from private pay, to the various forms of insurance. We also discuss what seniors can expect from Medicare, Medicaid, and other government programs. Lastly, I include our video tutorial that will quickly teach you how to look up your state’s average cost of assisted living, as well as our recommendations on how to get pricing and costs for specific facilities you are interested in!

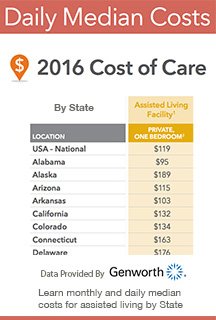

At this time, the National Median Cost for Assisted Living (Private, One-Bedroom) is: $3628

[Video] Cost of Assisted Living: Learn State Averages and For Specific Facilities

Video Tutorial Produced by Assisted Living Directory

Our short video tutorial will show you how to learn the average cost of assisted living facilities, nursing homes, adult day health care, and home care for your state – as well as our recommendation on getting specific facility pricing and costs.

Without a doubt, one of the most common questions that comes through our site has to do with how to pay for assisted living, and if Medicare covers any or all of the cost of assisted living. Many of the messages that we receive are from children of aging parents who are suddenly faced with the reality of placing their mom or dad into a long-term care environment, or assisted living – and not having any idea of how they, or their parents are going to afford the cost of the care. Unfortunately, too many families do not plan in advance for long-term care, and families are often times surprised…even shocked at how expensive assisted living can be. Unfortunately, many people make the assumption that assisted living will be covered by health insurance, Medicare, or our government in some way – only to learn that much of, if not all of the cost will be coming out of their own pockets.

Without thoughtful advance planning, out-of-pocket expenses for an aging loved one can be financially devastating.

Let’s first talk about what we have seen as far as the cost of assisted living.

Assisted Living, like most other housing arrangements, will be more, or less expensive based on a number of factors:

Location of the facility: Is the facility located in an upscale part of town, or neighborhood, or is it located in a more affordable part of town?

Are the rooms private, or semi-private? Will each resident have a ‘roommate’ and are bathrooms shared? A private room will most likely cost more.

What amenities and services are provided, and are extra services and amenities more expensive, or is everything included in the monthly cost? Some facilities may offer bare-bones amenities and services, that could be limited to simple housekeeping, basic personal assistance with hygiene and getting dressed, and basic daily meals. Other facilities may be more resort-like, offering things like a concierge service, a full activities calendar, organic foods and meals prepared by a highly talented or high-profile chef and kitchen crew – and decor and landscaping that has the look and feel of an elegant hotel. Naturally, one would expect facilities with more amenities to cost more. Additionally, residents with more complex health issues can probably expect to pay more for their care than a more independent resident who does not have a condition such as Alzheimer’s Disease or Parkinson’s Disease

Are items such as cable TV, telephone usage, and other utilities and ‘extras’ included, or will those incur an extra charge. If the monthly rate looks ‘reasonable’ – but these ‘extras’ aren’t included – the true cost of the facility may be higher than expected.

In general, the average cost of assisted living can be around $3500 per month. We have seen assisted living facilities in excess of $7000 per month that offer premier services and amenities. Finding an assisted living facility in your desired price range can take a lot of research, patience, as well as flexibility on location, amenities, and other ‘extras.’

If your loved one does not have significant health issues, and is fairly independent – then looking into a ‘senior community’ may be a better option in terms of expense. Senior Communities don’t offer the higher level of care as an assisted living facility, since they are targeted to more independent seniors – but they are likely to have a lower monthly cost than an assisted living facility.

How to pay for assisted living

Private-Pay: Paying for assisted living entirely ‘Out-of-pocket’ is often referred to as “Private-Pay.” This essentially means that the resident will be Assisted Living and advance planning for costsusing personal finances or assets to pay for all of the care and services. Keep in mind that people who are able to pay for care with insurance are also considered ‘private pay’ since this is not a payment that uses governmental sources or programs.

Long-Term Care Insurance: Like any other type of insurance, Long-term-care insurance is designed to offset the costs and expense of long-term-care for people who will not be able to qualify for Medicaid. Unfortunately, people who already have disabilities or illnesses will not qualify for long-term care insurance since they already require care and services (similar to a ‘pre-existing condition). Upper age limits may also exclude individuals from qualifying. In these cases, the individual will need to pay for care through other means, such as Medicaid, or through Private Pay. Most policies pay a fixed dollar amount towards each level of care with higher levels of care being reimbursed at an increased rate.

Careful shopping is essential when purchasing a long-term care policy, as one policy may be vastly different from another policy in terms of benefits and coverage, qualifications, rules, and flexibility, exclusions, and waiting periods. The cost of long-term care insurance can vary widely as well – sometimes in excess of $500 per month – a cost that can increase over time. We recommend that you research a number of long-term care insurance policies with the help of a qualified and trusted financial advisor as well as trusted family members.

Veteran’s Benefits: If you are a United States Veteran, you qualify for medical care through a Veterans Affairs medical facility (or referred to as a “VA Facility.” Unfortunately, there are often-times long waiting lists for beds at VA Facilities, and VA-run long-term care facilities, and priority is given to urgent conditions and service-related health issues and injuries. To find our more about Veteran’s Benefits, we recommend that you visit the Veteran’s Affairs website at www.va.gov

Medicare: Medicare is a big subject, and we’ll try to cover it to the best of our ability and knowledge, and how it applies to assisted living and long-term care. Basically, Medicare is a ‘federal system of health insurance for people over 65 years of age’ and can, at times, help to cover certain younger people with disabilities. Essentially, Medicare is broken down into 2 parts that apply to assisted living (we won’t go into Part D, which relates to Rx coverage). Medicare Part A is ‘hospital insurance that helps cover inpatient care in hospitals, skilled nursing facility, hospice, and home health care.’ Persons who are not eligible for premium-free Part A may be able to purchase Part A if you meet a number of criteria or conditions.

In General, Part A Covers:

Inpatient care in hospitals (such as critical access hospitals, inpatient rehabilitation facilities, and long-term care hospitals)

Inpatient care in a skilled nursing facility (not custodial or long term care)

Hospice care services

Home health care services

Inpatient care in a Religious Non medical Health Care Institution

As we understand it, Part A will cover a portion of the costs for up to 100 days. After 100 days, the patient pays for care. Medicare will not cover: Anything that is not medically necessary (which, unfortunately may include many of the services and amenities offered at many assisted living facilities); private rooms (unless it is for quarantine purposes, or is considered a medical necessity); custodial care; and other extras such as internet access, television, telephones, and any other non-medically necessary extras.

Medicare obviously is designed to motivate patients to get better quickly, as care is not ongoing.

Medicare Part B is available to individuals at an extra cost, and is designed to cover ‘cover medically-necessary services like doctors’ services, outpatient care, home health services, and other medical services.’

Assisted Living Directory is not qualified to be an expert on any aspect of Medicare. Our intent here is to provide a very basic understanding of what it covers. We recommend that if you wish to learn about Medicare, and what it may or may not cover in relation to assisted living and long-term care, to visit the Medicare Part A and Medicare Part B pages on the Official U.S. Government site for Medicare.

In addition, we found a useful tool on the Medicare site that allows users to find out if Medicare covers your Test, Item or Service

Medicare: Medicaid is designed to provide health insurance to those individuals who require financial assistance, and is paid for by federal and state funds. From the CMS website, “Medicaid is available only to certain low-income individuals and families who fit into an eligibility group that is recognized by federal and state law.”

/As far as Medicaid and Long-Term Care goes, it essentially pays for ‘basic’ nursing home care with no unnecessary amenities, or extras. Medicaid reimbursement rates are usually set by the state, and not by the assisted living facility or nursing home – and these rates are often set at a lower rate than what would be paid by other insurance sources. This essentially means that unfortunately, many assisted living facilities will not accept Medicaid patients, since they are likely to make less money from them. Eligibility for Medicated differs from state-to-state, but it is based on the individual having minimal income and few other financial resources and assets. To learn more about Medicaid, as well as eligibility and an excellent overview of the program, please visit the Centers for Medicare & Medicaid services site, which is a division of the U.S. Department of Health and Human Services, or call 800-MEDICARE.

Medigap Insurance: Medigap insurance is also referred to as “Medicare Supplement” – which refers to privately funded health care coverage and plans that are ‘sold to Medicare beneficiaries in the United States that provide coverage for medical expenses not or only partially covered by Medicare.’ There are a number of standard Medigap plans that ranged from basic coverage to more comprehensive coverage and service. To find out what the Medigap Basic Benefits are from plans A through N, please visit the Medigap Basic Benefits page on the Medicare site.

To find a Medigap Policy in your City or Area, we recommend that you use the Medigap Policy Search tool on the Medicare website.

We’ve briefly covered the most common ways that individuals and families might pay for, or cover the costs of assisted living. We did not cover secondary insurance, which may be insurance from employers, or other groups that may cover seniors through post retirement.

In the many years that we have managed Assisted Living Directory, we’ve received countless messages, and calls for help from families and individuals confused about paying for assisted living, and how to cover the costs. We’ve also witnessed the frustration experienced by assisted living facilities having difficulty accepting new residents who are unable to cover the costs of assisted living, or who have incorrectly assumed that their insurance will cover part of, or all of the costs.

We hope that any family with aging loved ones, or individuals who may need assisted living or long-term care in the future will take the time to research all of the insurance options available, and what they will or will not cover, and to talk to a trusted and qualified financial advisor well before the services and care are actually needed.

Good and thorough advance planning is the only way to minimize, or eliminate any financial surprises or frustrations as you prepare for retirement, and the possibility of living in an assisted living or long-term care environment.

Assisted Living Directory works with an experienced and talented group of senior care advisors who can help you to understand which care options you can (or can not) afford based on your budget, insurance, or financial resources or limitations.

No Obligation

Assisted Living with Costs, Expenses and How To Pay for Assisted Living